This can happen after a long war in which a devastated country gets a chance to rebuild. This is a broad category covering any period when a country that was previously underperforming its fundamentals gets a chance to catch up. This definitely happens, but after the inevitable bust, the whole period will eventually average out to 1% to 1.5% per year. But it doesn’t increase GDP per capita and it shouldn’t be considered the same as normal economic growth, which is always between 1% and 1.5% per year. Population growth will increase GDP, and it will look like a high economic growth rate. But Piketty says all such situations are abnormal in one of a few ways.įirst, they can have high population growth. This came as news to me, since I often hear about countries and eras with much higher growth rates. The most important thing I learned from Piketty is that since the Industrial Revolution, normal economic growth has always been (and maybe always will be) between 1% and 1.5% per year. While more knowledgeable people than I are probably already familiar with much of this, I used him as an Econ History 101 textbook and was not at all disappointed in the results.

His results touch on almost every big question in politics and economics, and are able to propose sweeping theories where other people resort to parochial speculation. Armed with these data, he tries to put together a theory of the very-long-term forces at work in economic change.

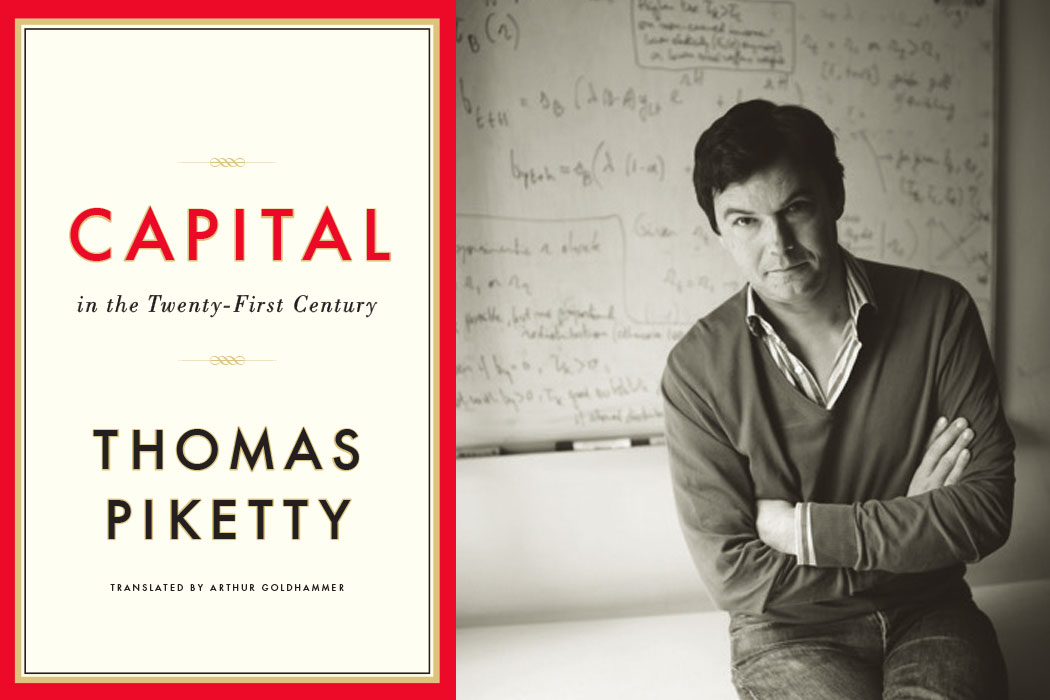

Piketty spent decades combing through primary sources trying to get good statistics for what the economies of various Western countries have been doing over the past 250 years. This is much more interesting than it sounds. It’s a book about quantitative macroeconomic history. Thomas Piketty’s Capital In The Twenty-First Century isn’t just a book on inequality.

0 kommentar(er)

0 kommentar(er)